Answers to the most common questions visitors and new arrivals ask about how to access your money while in Mexico.

By Sue Bell

Whether you are just coming to La Paz for a visit, or you are a part-time or full-time resident, figuring out how to get access to your money in your home country’s accounts to pay for things here in Mexico is critically important. Visitors and residents alike often have questions about the best ways to deal with fluctuating exchange rates, bank machine fees, international charges on credit cards, and hidden fees for exchanges. Understanding how international banking and credit cards work in Mexico is important, so you can make sure you have access to your money without paying unreasonable fees.

In this post, we take a look at the common questions our La Paz visitors and residents often ask about accessing their money.

Carrying Cash: Should I buy all my Mexican Pesos before heading to Mexico?

The economy in Mexico is still very cash-based, so it is a good idea to always have at least some cash with you when you travel here. However, while it may be a good idea to get some pesos from your bank before heading to Mexico, you don’t have to carry all the cash you will need on your trip. First, there are laws about how much cash you can bring into the country. In addition, no matter where you travel, it’s never a good idea to carry large sums of cash on your person, and neither is it a good idea to leave a lot of cash in your apartment or car or hotel room. After all, you don’t go carrying that kind of money around in your own country or leave it lying around your house, do you?

ATMs in Mexico – Will my debit card work in Mexico?

It’s a good idea to bring some pesos with you as you cross the border, but not too much. Once you are in Mexico, you will need to be able to access more pesos, and ATMs are probably the most convenient option. That said, you are not likely to find ATMs for your home bank in Mexico, unless you deal with Scotiabank, HSBC or Citibank. Even then, the branches of these banks in Mexico are not actually part of the same organization, although they may waive fees to use their ATMs.

To help make sure you are not paying more than you need to take money out of an ATM, before you leave home, check with your bank to see if they have a reciprocal agreement with any international banks that will let you make withdrawals with no charge. Some banks offer no charge for using bank machines internationally, while others only permit withdrawals from specific banks. Still others have high fees for using any bank machines out of country. There are even some credit unions whose debit cards do not work at all in Mexico, so be prepared, and ask before you travel.

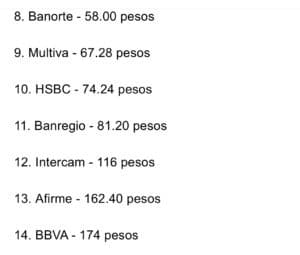

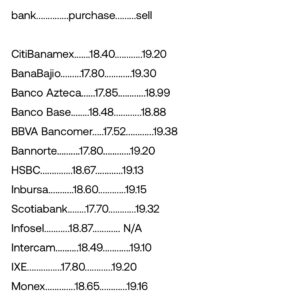

Another good tip for using ATMs is to do a survey of banks in your destination to find out their bank machine fees before actually making a withdrawal (they can range from 20 pesos per withdrawal to 200 pesos per withdrawal). Then, do a check of the exchange rate the bank gives on the withdrawal. Some will offer a low interbank withdrawal fee, but they make up the difference by giving a less favorable exchange rate.

Most importantly, if you are using ATMs, avoid the ATM Scam

On most ATMs in Mexico, once you have put in your card, entered your PIN, chosen your account and indicated the amount you want to withdraw, you will then see a screen that offers you a conversion rate and tells you how much your peso withdrawal will cost in dollars. Many people accept the rated believing that if they don’t the machine will not dispense the money, but don’t fall for it! The conversation rate they offer is a hugely inflated number that ends up costing you much more than it should to make your withdrawal. When you see that screen, click on “decline conversion rate”. The machine will still dispense the money, but at your bank’s far better conversion rate.

Can’t I just use my American or Canadian credit card in Mexico?

While it is certainly possible to use credit cards, there are still many businesses, restaurants, tour companies and stores in Baja that are cash based. Others may take credit cards but charge extra fees for the transaction. You may also want to check to see what your credit card company’s policies are regarding international charges. Are there international charge fees? What is their exchange rate in comparison to the going rate? Are there any other fees? Also check with the place you intend to make your purchase to make sure they accept cards and don’t charge an additional fee for using them.

A few things to be aware of when using credit cards in Mexico:

- Fluctuating exchange rates can significantly impact the final price you pay

- Poor exchange rates offered by many credit card companies mean you may be paying more than you think you are

- Many banks charge international charge fees

- Many businesses charge local fees for using any kind of card

What about exchange rates?

Dealing with the ever-changing rate of exchange while traveling can be a real challenge. Knowing when the peso is strong can help you get more for your money. When you need to bring in large sums of money, such as when you are buying a vehicle, a property or building a home, this is particularly important, and paying attention to the exchange rate when you wire money can save you hundreds if not thousands of dollars.

With modern technology, there are many options for helping you to stay on top of the exchange rate. Consider downloading a currency monitoring app or using one of the many websites that let you track real-time rates and plan your withdrawals accordingly. Here are a few of the ones we recommend:

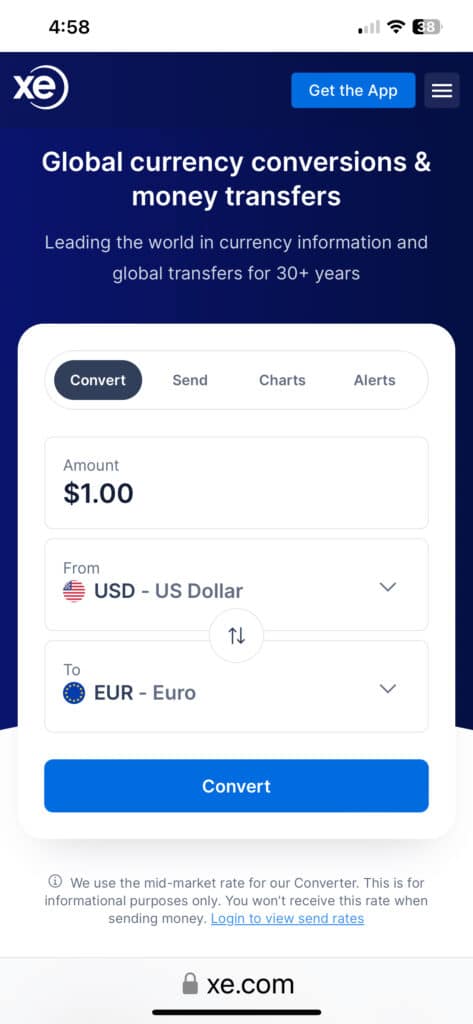

XE ( http://xe.com ) is a money transfer service that lets you create an account to transfer money. They also offer tools that allow you to select a setting to monitor the exchange rates and get notified when the rates are better, so that you can time your purchase or transfer and get more bang for your buck. The XE Currency app, which you can download to your phone, puts the current currency rates at your fingertips whenever you need them AND connects you directly to XE services to do the transfer within the same app.

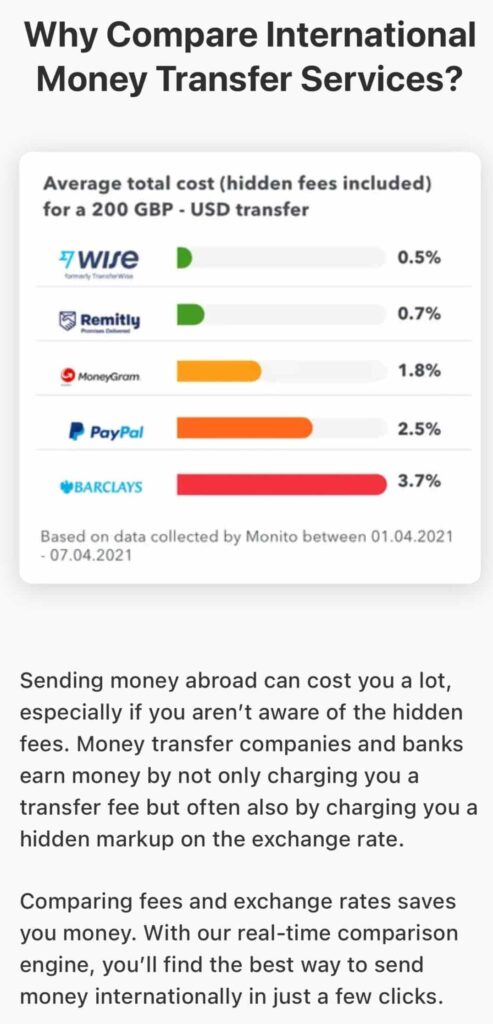

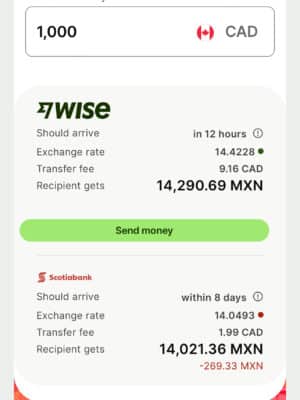

Wise (http://wise.com) is another international money transfer service that has very good exchange rates and low fees. It works in Canada, the USA and Mexico.

Currency Converter Calculator is another free app for your phone that provides convenient access to the current exchange for any currency, but without being connected to any of the money transfer services. It can be a great way to check how the rates that the bank is offering compare to the actual exchange rate so you can more clearly see what the bank is charging for their services.

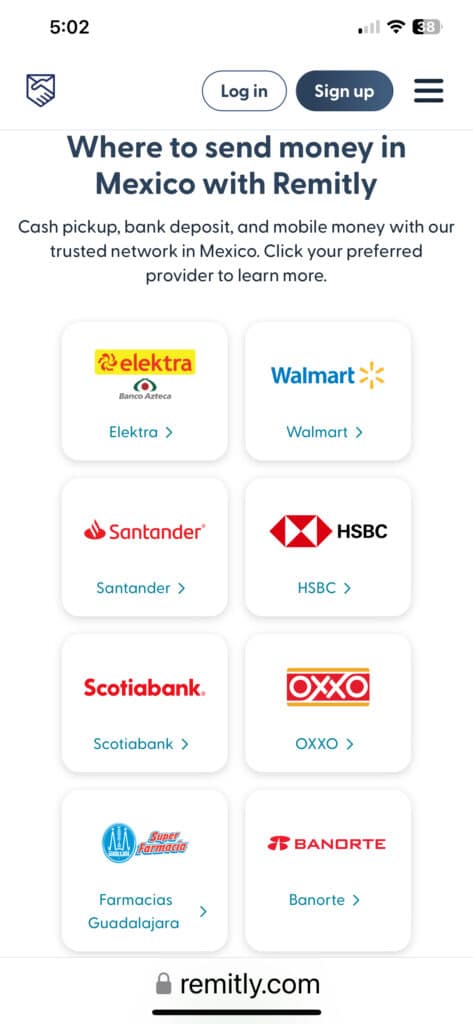

Remitly ( http://Remitly.com ) is another service for international money transfers, and it works with most Mexican banks, enabling you to send money directly to accounts at Santander, HSBC, Scotiabank, Bodega Aurrera, BBVA, Banorte, etc. You can also use it to send money to Walmart, Elektra, Oxxo and Guadalajara Farmacias for pick up as well, similar to a WellsFargo money order. They offer a guaranteed delivery time for the funds, which can be important and valuable, especially if you are transferring money for the purchase of land or a house.

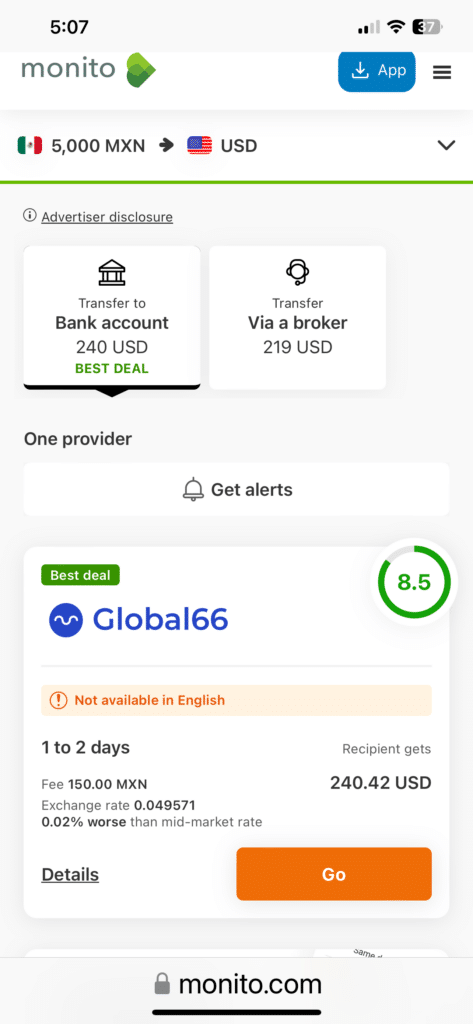

Monito (http://monito.com ) is an app that tracks the current rates and fees for a wide range of money transfer services, allowing you to compare in real-time to make the best possible decision before making your transfer.

Do I Need a Mexican Bank Account?

With the volatility of the exchange rates, if you are a full-time resident here in La Paz, it can make sense to consider transferring large sums when the rates are favorable. This can save you money in the long run, but it means you will likely need an account at a local bank here in Mexico. We will explore the topic of opening a Mexican bank account in our next blog post.

Sue Bell is Baja Life Realty’s office and marketing administrator, helping us out with a variety of projects, including Spanish translations of key documents, keeping our listings up to date, and promoting the La Paz lifestyle on our Facebook page and blog. In addition to her work at Baja Life Realty, Sue is a bilingual personal concierge. That means she helps clients with setting up services such as banking, utilities, cell phone service and more. She hosts a Starter Kit for Living in Baja workshop, which teaches new homeowners how to connect with local contractors, join local expat groups, source furniture and other items for your home, and much more. To learn more about Sue’s personal concierge service you can check her out on facebook at https://www.facebook.com/profile.php?id=61551697332005 or contact her via email at sue@suecasalapaz.com

Sue Bell is Baja Life Realty’s office and marketing administrator, helping us out with a variety of projects, including Spanish translations of key documents, keeping our listings up to date, and promoting the La Paz lifestyle on our Facebook page and blog. In addition to her work at Baja Life Realty, Sue is a bilingual personal concierge. That means she helps clients with setting up services such as banking, utilities, cell phone service and more. She hosts a Starter Kit for Living in Baja workshop, which teaches new homeowners how to connect with local contractors, join local expat groups, source furniture and other items for your home, and much more. To learn more about Sue’s personal concierge service you can check her out on facebook at https://www.facebook.com/profile.php?id=61551697332005 or contact her via email at sue@suecasalapaz.com

" alt="Baja Life Realty" />

" alt="Baja Life Realty" />